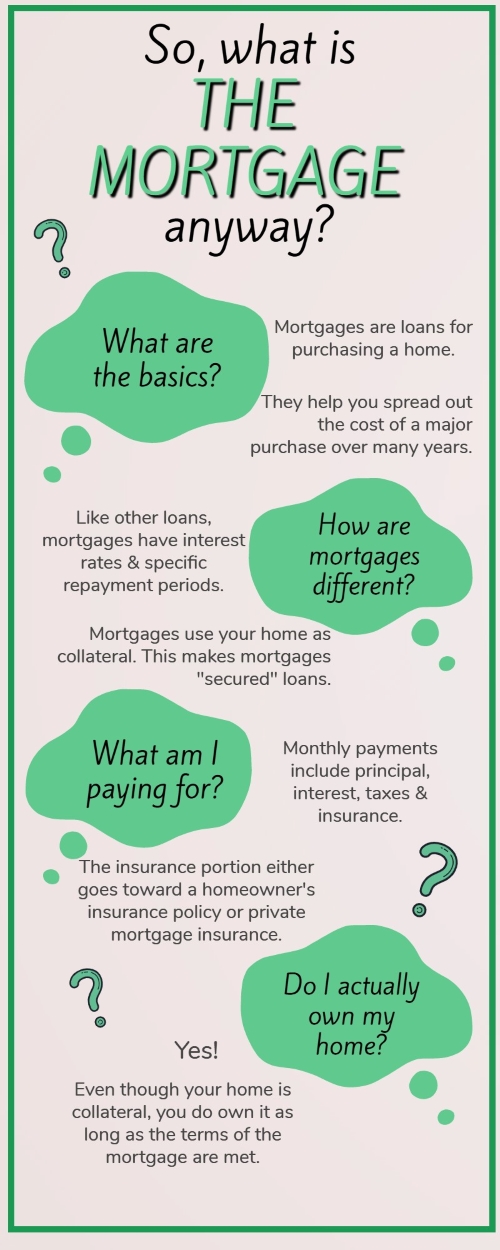

For many, the concept of buying property seems completely unfamiliar - and paying for it might make you wonder, “what is ‘the mortgage,’ anyway?” If you’ve rented a house or apartment before, you’re familiar with monthly payments and extra fees for maintaining the property. But how is a mortgage different?

To help you gain a better understanding of what a mortgage actually is and how it works, here is a quick guide to the basics:

You can think of mortgages similar to car loans. You pay monthly repayments with fixed interest until you pay off the loan.

Mortgage loans work because only few buyers have the money they need up front to make this kind of huge purchase. Instead of paying out-of-pocket, a mortgage helps you spread your purchase costs over several years, allowing you to buy homes at lower costs.

Mortgage loans have interest rates and agreed upon repayment periods like any other loan. However, some important distinctions distinguish mortgage loans from other types of loans.

A mortgage is a secured loan, which means it requires collateral - an asset the lender can seize if you default on the loan. In the case of mortgages, the property itself is collateral.

An unsecured loan doesn’t require collateral, but may have higher interest rates or minimum qualifications to help the lender mitigate risk.

You pay your mortgage payment monthly. Mortgage loans comprise four major costs: principal, interest, taxes and insurance. Principal is the actual amount of money you borrow, and interest is the percentage that goes back to the lender.

Property taxes and insurance also factor into your monthly payment. Insurance could be either mortgage insurance or homeowners insurance, depending on which type you have.

Buying a home means you’re responsible for making decisions about the property, but a mortgage can make the concept of ownership confusing. However, the simple answer is yes, you do own your home as long as the terms of the mortgage are met.

Even knowing the basics about a mortgage loan, the process can seem daunting. However, this key information will help guide you through the process of becoming a homeowner.

Johnna grew up in Amherst NH and still has strong ties to the Amherst & Mont Vernon Communities. Johnna moved to Manchester at 19 when she purchased her 1st home. She has resided in the West Side of Manchester since 2007. Always having a strong interest in real estate, Johnna and her husband, Jeff, started investing in rental properties in 2017 with the purchase of a 2 bedroom condo in Manchester. They now own 10 properties with the goal of growing to 60 total rental properties. In 2020 Johnna and Jeff started adding short term rentals to their portfolio focusing in the NH Lakes Region and Southern Maine Coast. Johnna achieved Airbnb Super Host and VRBO Premier Host status within the first year.

From May to October Johnna divides her time between Manchester, NH and her beach cottage in Wells Maine. Johnna’s extensive experience with both long term and short-term rental properties makes her the ideal real estate agent to help you start or build your real estate investment portfolio. Johnna works with a lot of home owners selling their homes and buying homes simultaneously and also sellers relocating out of the area.

Johnna prides herself in being hard working, dependable and down to earth. In her free time, she enjoys reading, jigsaw puzzles and spending time outdoors with her husband, dogs and friends.